The question on every beginner's mind...

OK! You made the jump and clicked the button. You’re here to find out what investing actually is, and how you can take advantage of it. Amazing. Let’s get right into it.

Investing (noun) – the act of allocating resources, usually money, with the expectation of generating an income or profit.

That’s it… in essence. Investing involves purchasing assets (see below for what sorts of assets), which are anticipated to increase in value over time. You buy something now, the price goes up, then you sell it later for a profit.

The primary objective of investing is to grow wealth through the appreciation of asset values or by earning returns in the form of interest, dividends, or other forms of income.

The list of things you can buy as an investment is almost limitless.

Let’s start with the less common ones, like vintage sneakers, baseball cards, art, or even NFTs (but be wary of that last one!). These physical or digital items will have some form of uniqueness, whether it’s a signature from Michael Jordan on a shoe he wore in a game, the fact that it’s a rare, mint condition card, or that the artist who created the art piece or NFT is famous, very talented or ground-breaking in some other way. As a result of its scarcity, and uniqueness, each of these non-traditional investments will have a value that is determined by “the market” (or many different people).

In the more traditional world of investing, the most common investments are in stocks, bonds, real estate, crypto, commodities and precious metals. Let’s look at each one in detail.

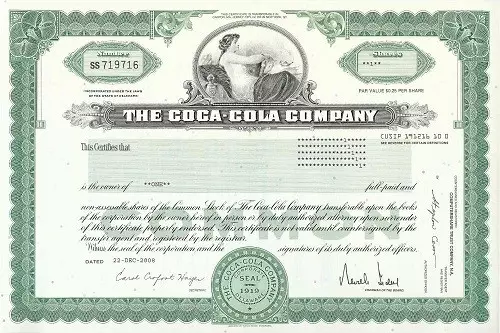

A “stock” is, quite literally, a piece of paper that represents a part ownership of a company. When you buy a stock, you purchase a share of the company, giving you a claim on part of its assets and earnings.

The terms “stocks” and “shares” are used interchangeably, because of their history, and because they essentially mean the same thing, expressed in two different ways.

A long time ago, investors (picture in your mind an aristocrat in a tall black hat) would purchase a part of a company, and they would be given paper “shares”, or more accurately, paper “stock certificates” to prove their ownership of that company. Each stock certificate would represent a specific ownership share of that company.

There was no set formula for how many stocks would be issued, though, so to determine what each share was worth, you had to understand how valuable the company was, and know how many total shares had been issued. For example, if a company was worth $100 million, and there were 1 million shares issued, each share would be worth $100.

In the old days, the biggest challenge with investing was ownership and custody of the physical stock certificates. Investors generally kept their stocks in a safe in their house, or possibly in a more secure vault at a bank. Additionally, stocks could trade hands, if one investor decided to sell their shares to another investor. So the easiest way to prove who owned the stock was for the investor to produce the stock certificates whenever required (we’ll look at what those reasons are a little later on).

These days, stocks aren’t actually passed around physically; they’re traded digitally on a stock exchange (we’ll cover stock exchanges in part three). Stocks are now quite easy to buy and usually, but not always, easy to sell.

A “bond” is a fixed-income instrument (technically also a piece of paper) that represents a loan made by an investor to a borrower, which can be a corporation, municipality, or government.

The borrower issues the bond to raise funds for various purposes, such as financing projects or managing debt. When an investor purchases a bond, they agree to lend the issuer a specific amount of money for a predetermined period of time.

In return, the issuer commits to pay the investor regular interest payments, known as coupon payments, at a fixed or variable rate. Upon the bond’s maturity, the issuer repays the bond’s face value, or principal, to the investor.

In the image example above, the investor would have loaned $1,000 to the Canadian Government on April 1, 2001, and would be entitled to receive a set amount of interest (it was something around 6% back then) for 10 years. The bond would mature on April 1, 2011, at which time the Canadian Government would repay the investor their original $1,000.

Bonds are considered relatively safe investments compared to stocks, as they typically offer more stable and predictable returns, along with repayment of the initial investment on the maturity date.

Real estate investing refers to the practice of acquiring, owning, managing, renting, or selling properties to earn a return on investment. This type of investing can encompass a variety of property types, including residential, commercial, industrial, and land.

Investors in real estate aim to generate income through rental payments from tenants, appreciation of property value over time, or profits from selling properties at a higher price than the purchase cost.

Crypto investing refers to the practice of buying, holding, and trading cryptocurrencies with the goal of generating financial returns. Cryptocurrencies are digital or virtual assets that use cryptography for secure financial transactions and operate on decentralized networks based on blockchain technology.

The most well-known cryptocurrencies are Bitcoin and Ethereum, but there are many others, each with unique features and use cases.

Crypto investing carries substantial risks, including high volatility, regulatory uncertainties, security vulnerabilities, and potential market manipulation. Despite these risks, many investors are attracted to the potential for high returns and/or the innovative nature of blockchain technology. Successful crypto investing requires thorough research, risk management, and staying informed about the rapidly evolving crypto market.

For more detailed information, check out my Investor’s Guide to Crypto Investing.

Commodities investing involves buying and selling raw materials like gold, oil, and agricultural products to profit from their price changes.

Commodities are typically grouped into four categories: metals (gold, silver, copper, etc.), energy (oil, natural gas), agriculture (wheat, corn, coffee, etc.), and livestock (cattle, hogs, etc.).

Commodities investing can offer diversification benefits to an investment portfolio, as commodities often have low correlation with traditional asset classes like stocks and bonds. However, it also involves risks such as price volatility, geopolitical factors, supply and demand imbalances, and changes in regulatory environments. Successful commodities investing requires a solid understanding of market dynamics, careful analysis, and strategic risk management.

Precious metals investing refers to the practice of buying and holding valuable metals, such as gold, silver, platinum, and palladium, with the goal of preserving wealth and generating financial returns.

These metals have intrinsic value due to their rarity, industrial applications, and historical significance as a store of value.

There are many different and unique ways to invest, but the concept of investing is simple. Investing involves buying something with the expectation that it will increase in value in the future.

There may or may not be regular payments associated with owning an investment- as is the case with bonds, dividends, or rent payments for real estate investors.

The best investments generally have a real, concrete reason why their value will increase in the future. That may be because the company grows and is more profitable, because the land in a particular area becomes more scarce as population grows, or because there is less gold available to be mined each year.

Learn about the world of investing

We noticed you're visiting from Canada. We've updated our prices to Canadian dollar for your shopping convenience. Use United States (US) dollar instead. Dismiss